Lessons from "Popular Delusions and the Madness of Crowds"

- TheDivergentTrader

- Jun 17, 2023

- 3 min read

Hey there, my friend!

Today, I want to talk to you about an amazing book called "Popular Delusions and the Madness of Crowds" by Charles Mackay.

Don't let the fact that it was written in 1841 fool you—its insights are still incredibly relevant, especially for traders like us who want to understand the sometimes irrational and crazy world of finance.

Let's dive in and explore the valuable lessons it has to offer.

The Herd Mentality

You know how people tend to follow the crowd without questioning why?

Well, Mackay refers to this as the "herd mentality," and it's a significant factor in trading.

It's like when everyone starts talking about a particular investment, and suddenly, it feels like you're missing out if you don't join in.

The book reminds us to be cautious of such behavior and encourages us to think independently, do our own research, and stick to our own strategies that we have tested and verified and not blindly follow what everyone else is doing.

A very big and important lesson!

Speculative Frenzies

Another interesting concept Mackay discusses is speculative frenzies. It's when people get caught up in the excitement of making quick profits without considering the risks involved.

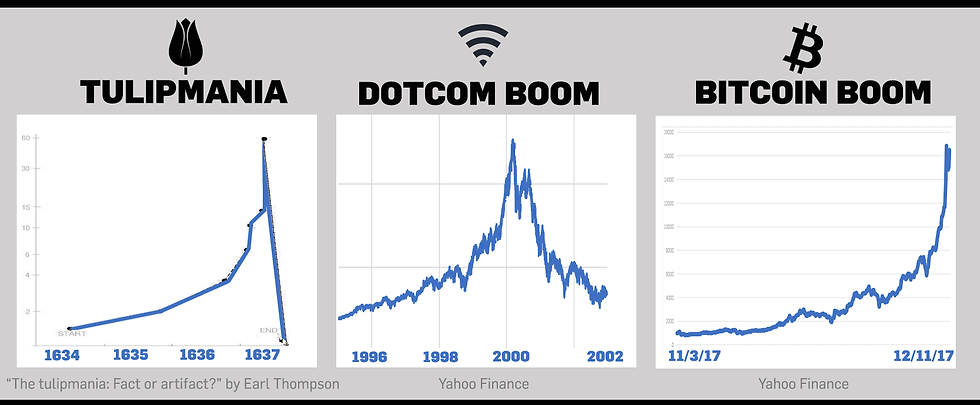

Sound familiar? We've seen this happen many times in the financial world from the Dotcom bubble to Bitcoin. These frenzies create market bubbles that eventually burst, causing losses for those who got caught up in the frenzy.

By being aware of speculative manias, we can protect ourselves and make more informed decisions.

See Below:

(Nothing changes, the madness of crowds is always prevalent in the world of trading)

The Impact of Emotions

Now, let's talk about emotions. Have you ever made impulsive trading decisions driven by overconfidence or greed?

Well, you're not alone! Mackay emphasizes how emotions have clouded numerous people's judgment.

In today's world often we see, traders become overly confident in their ability or they get tempted by the promise of making a quick buck and end up making the wrong decision which leads to risky decision-making and, ultimately, regret.

Another powerful lesson in making sure you keep your emotions in check!

(If you would like more help with managing emotions click here)

The Contrarian Approach

Here's something fascinating from the book: going against the crowd can actually be a profitable strategy.

Mackay suggests that by questioning popular opinions and conducting our own analysis, we can identify opportunities that differ from the prevailing sentiment.

It's called the contrarian approach. Contrarian investors and traders look to benefit when the popular delusions eventually correct themselves.

So, it's okay to think differently from the crowd.

This is why you have to stick to your own strategy that you have proven yourself and not follow what 95% are doing.

Final Thoughts

"Popular Delusions and the Madness of Crowds" is a fantastic guide for traders like us.

It teaches us to think independently, be aware of speculative frenzies, manage our emotions, and even consider the contrarian approach.

By incorporating these lessons into our trading strategies, we can make smarter decisions and avoid being swept away by market irrationality.

So, my friend, let's take a step back from the noise and remember the timeless wisdom of this book.

Let's approach our trading journeys with a rational mindset, free from the pressures of the herd and the frenzy.

And this way you can navigate the complexities of financial markets with a clearer perspective.

And if you've not read this yet I highly recommend grabbing yourself a copy!

Have an incredible day my friend!

And happy trading!

Alan Edward

THE DIVERGENT TRADER

‘’Want to cultivate the mindset of patience, discipline, and resilience?’’

INTRODUCING MY NEW COURSE!

In as little as 6 weeks, you will gain ALL the tools needed to transform yourself into a patient, focused, and rational trader

These are all the methods I’ve personally used myself to help me re-wire my brain into the disciplined and confident trader that I am today.

Comments