How To Overcome A Drawdown?

- TheDivergentTrader

- Oct 9, 2022

- 4 min read

Updated: Oct 11, 2022

Today I want to talk about a common question that I get asked regularly and a situation that many traders face and that is how to overcome a drawdown.

What Is A Drawdown?

A drawdown is when your system goes through a period of losses and your account balance goes into the negative.

Many traders struggle here because they have not learned how to overcome them and the emotional distress that can come with them.

What To Do First?

Firstly you need to review your results and compare them with your historical data, Is this normal or not?

Has your edge stopped working or is it a normal distribution? I like to review my trades in 20 trade sample sizes to always be on top. Read more on this here

If you have a statistical edge and have tested and verified it then you will know what your 3 most important metrics are:

- Win rate

- Risk Reward

- Max Drawdown

Knowing just these 3 things will give you an understanding of how your system works.

For example, you will know the expectancy of a losing streak based on your win rate to risk-reward. When you know your data you will have far more confidence to push through.

Here's some data you can use as a reference:

If you have not done the work beforehand then of course you will not be prepared for drawdowns as you are going in blind.

This is what 95% are doing. If you want to be an outlier you have to put in the work.

Secondly, if you have traded your system for a while you should also know what is usual and unexpected. If it is unexpected then you need to review your previous trades in depth and the only way to do that is if you have been journaling and recording your trades.

Awareness is key.

More awareness of how your system performs is vital or you are simply going in blind and will eventually give up or ruin your results by emotional trading.

Make sure you start to journal your trades, take visual screenshots, and track your emotions. This will have a big impact on you in the long run as you can analyze, dissect and improve.

You can do all of these with my Emotional Trade Tracker.

Understand how probabilities work

You need to have a probabilistic mindset and to do this you need to understand how the Law of Large numbers works.

There is a random distribution between wins and losses in the short term but in larger sample sizes the probabilities begin to work.

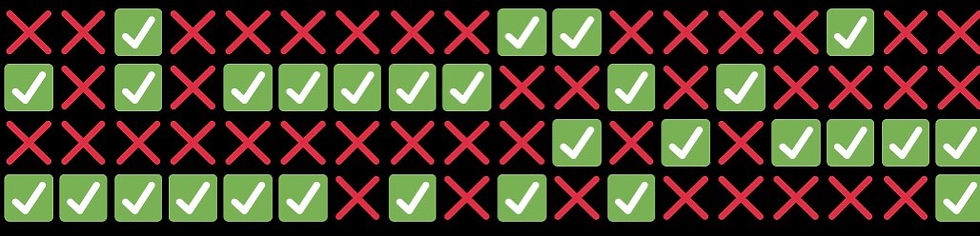

In the below image imagine this is a series of trades.

Now imagine if every ✔ was a +3R win And each ❌ was a -1R loss Total = +44% Return

But would you have stuck with the strategy after only 1 win in 9 trades or losing 10 in a row?

Most wouldn't...

But if you understand your metrics as well as probabilities you would have far more discipline to keep going because you have 'evidence' that supports this as normal.

Those who have not would have given up and switched strategies. And this my friends are the exact reason why most fail they have no understanding of how their system or probabilities work.

(I go more into more detail on the Law of large numbers, probabilities, and position sizing in my book ''The Blueprint To Trading Psychology.'' )

Having faith in probabilities is key especially in the short term when the trades are random. You may think your system does not work but it's just you haven't got a large enough sample size or it's just a normal occurrence of your system's win rate.

When you do understand it you can use this as a tool to constantly remind yourself of the moments when these normal sequences of losses happen and give you the confidence to push through.

Tips To Help With Drawdowns?

It's not so much about getting out of a drawdown that is the main problem it's being able to keep your confidence up that is key.

Here are some quick tips you could implement when hitting a DD.

- Shorter Targets, help increase the win rate + increase confidence

- Change your environment - Put happy music on/Exercise. The more you focus on the negative the more it will consume you.

- Stop the thoughts > Take deep breaths and reframe

- Have the data with you always to reference

- Backtest your system when in a DD to remember

- Reward yourself e.g If you follow the plan for the next 10 trades then treat yourself.

Final Thoughts

Drawdowns are not easy you feel lost, and doubtful and will think of changing strategy.

But if you have done the work proving it's normal for your system then you will have far more power to overcome the drawdowns.

As well as know if it is not the system you are trading but actually because of you and therefore be able to create corrective actions to fix the problem.

On the other hand, if you have not done the work you will always be going around in circles and blaming the strategy as the reason it's not working.

When in reality it is probably just going through a normal distribution that all strategies experience at some point.

Hopefully, the tips in this newsletter have helped you a little bit! Please let me know if it did in the comments below!

Have an incredible day my friend!

Speak soon,

Alan Edward.

Want to learn more?

Check out my:

I go into much greater detail and show you my step-by-step blueprint that I used to become a consistent trader.

Tap the 'I Want This'' button below to get started now!

Always feels great hearing from u sirrrrr